Navigating the World of Consumer-Saving Strategies

In a world where every dollar counts, adopting effective consumer-saving strategies is paramount. Let’s delve into practical approaches that empower consumers to maximize value in every purchase, ensuring financial well-being without compromising on quality or enjoyment.

Smart Budgeting: The Foundation of Savings

To embark on a journey of consumer-saving, start with a solid budget. Categorize expenses, allocate funds for necessities, and set aside a portion for savings. This foundational strategy allows you to understand your financial landscape and make informed decisions, steering clear of unnecessary expenditures.

Embracing the Power of Comparison Shopping

Comparison shopping is a consumer-saving strategy that never goes out of style. Before making a purchase, explore different retailers, online platforms, or services to compare prices. This strategy ensures you’re getting the best deal, whether it’s for everyday essentials or larger investments.

Leveraging Technology for Deals and Discounts

In the digital age, technology is a powerful ally in the quest for savings. Explore apps, browser extensions, and websites that offer exclusive deals and discounts. This consumer-saving strategy enables you to stay informed about ongoing promotions, ensuring you never miss an opportunity to stretch your budget.

Strategic Loyalty Programs: Maximizing Rewards

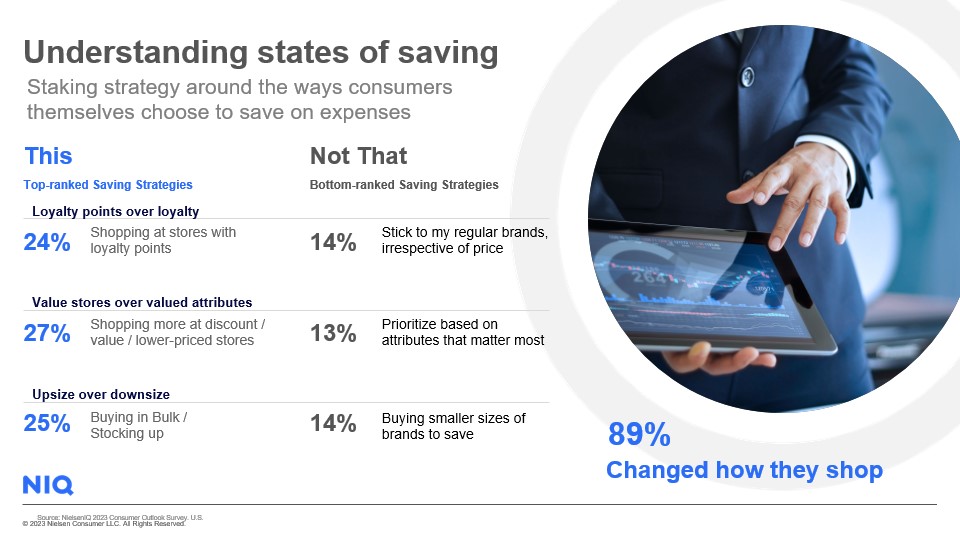

Many businesses offer loyalty programs that reward repeat customers. Take advantage of these programs by strategically aligning your purchases with retailers that provide worthwhile rewards. This consumer-saving strategy turns your regular spending into opportunities for discounts, cashback, or exclusive perks.

Mindful Couponing: Clipping and Clicking for Savings

Couponing remains a classic yet effective consumer-saving strategy. Whether it’s traditional paper coupons or digital equivalents, incorporating them into your shopping routine can lead to significant savings. Keep an eye on promotional offers and utilize coupons for items on your shopping list.

Timing Is Everything: Capitalizing on Sales and Promotions

Patience pays off when it comes to consumer-saving strategies. Monitor seasonal sales, holiday promotions, and special events. Timing your purchases strategically can result in substantial discounts, allowing you to enjoy quality products and services without breaking the bank.

Negotiation Skills: A Consumer’s Secret Weapon

Don’t underestimate the power of negotiation. In various situations, such as when dealing with service providers or making significant purchases, polite negotiation can lead to better deals. This consumer-saving strategy is particularly valuable when it comes to subscription fees, contract renewals, or one-time purchases.

DIY and Skill Development: Frugality in Action

Embracing a do-it-yourself (DIY) mentality and developing new skills can contribute to consumer savings. From basic home repairs to crafting personalized gifts, this strategy not only reduces expenses but also fosters a sense of self-sufficiency and creativity.

Community and Peer Recommendations: Shared Wisdom

Consumers can benefit greatly from the experiences of others. Engage with online communities, forums, and social media groups where individuals share their savings tips and product reviews. This consumer-saving strategy provides valuable insights, helping you make informed choices and avoid potential pitfalls.

Continuous Financial Education: The Key to Long-Term Savings

To sustain consumer-saving strategies, invest in continuous financial education. Stay informed about personal finance, investment options, and economic trends. This strategy empowers you to make informed decisions, adapt to changing financial landscapes, and continue maximizing savings in the long run.

For a comprehensive guide on adopting effective consumer-saving strategies, explore Consumer-saving strategies. Arm yourself with knowledge and practical tips to navigate the consumer landscape, making every purchase a step towards financial well-being.